Calculate loan payment student – Student loan payments can be a daunting prospect, but understanding the process and your options can help you navigate the repayment journey with confidence. From calculating monthly payments to exploring additional considerations, this guide will provide you with the essential knowledge to manage your student loan debt effectively.

Understanding the components of a student loan payment, including principal, interest, and fees, is crucial for calculating your monthly payment. Different repayment plans, such as the Standard Repayment Plan and the Graduated Repayment Plan, impact the amount you pay each month.

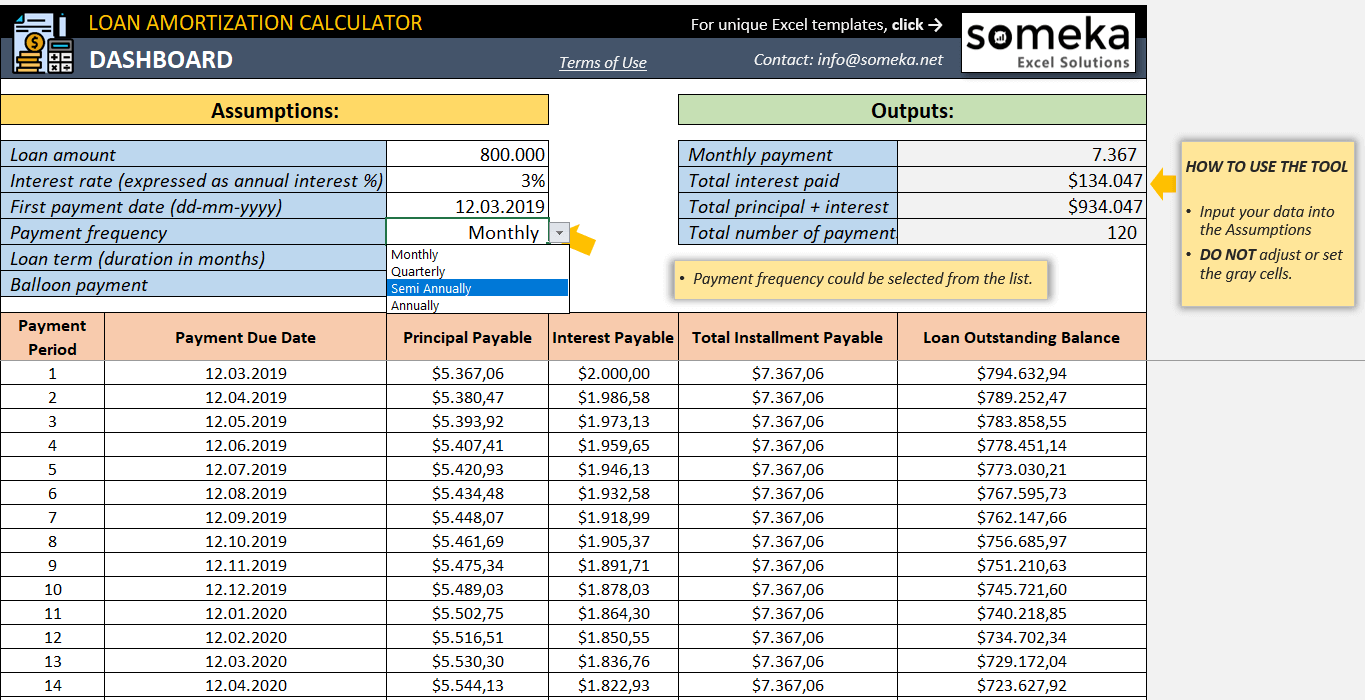

Our guide will walk you through the steps of calculating your monthly payment using a formula and demonstrate how to use an online loan calculator for convenience.

Understanding Student Loan Payments

Student loan payments consist of three primary components: principal, interest, and fees. The principal represents the original amount borrowed, while interest is the cost of borrowing the money. Fees may include origination fees, late payment fees, and other administrative charges.Different

student loan repayment plans can significantly impact monthly payments. Some common plans include:

- Standard Repayment Plan:Fixed monthly payments over a 10-year period.

- Graduated Repayment Plan:Payments start lower and gradually increase over a 10-year period.

- Extended Repayment Plan:Payments are lower than the Standard Plan, but the repayment period is extended to 20 or 25 years.

- Income-Driven Repayment (IDR) Plans:Payments are based on a percentage of the borrower’s income, and loan forgiveness is available after a certain number of years.

The choice of repayment plan depends on factors such as the borrower’s income, debt-to-income ratio, and financial goals. It’s important to consider the long-term implications of each plan, including the total amount of interest paid and the potential for loan forgiveness.

Calculating Student Loan Payments

Understanding the monthly payments for your student loans is crucial for effective financial planning. This article provides a detailed guide on calculating student loan payments using a formula and an online loan calculator.

Formula for Calculating Monthly Payments

The formula for calculating the monthly payment for a student loan is:

Monthly Payment = (Loan Amount

- Annual Interest Rate / 12) / (1

- (1 + Annual Interest Rate / 12)^(-Number of Payments))

- Loan Amount: The total amount borrowed.

- Annual Interest Rate: The interest rate on the loan, expressed as a decimal (e.g., 5% = 0.05).

- Number of Payments: The total number of payments to be made over the life of the loan.

Step-by-Step Guide for Using an Online Loan Calculator

- Visit a reputable online loan calculator website.

- Enter the loan amount, interest rate, and loan term.

- Click “Calculate” to generate the monthly payment.

- Review the payment schedule and other loan details provided by the calculator.

Factors Affecting Loan Payments

Student loan payments are determined by several factors, including the loan amount, interest rate, and loan term. Understanding these factors can help borrowers make informed decisions about their student loans.

Loan Amount

The loan amount is the total amount of money borrowed. A higher loan amount will result in a higher monthly payment, as more interest will be charged over the life of the loan.

Another valuable resource for students considering student loans is the ability to calculate loan payment student loans with different scenarios. These calculators allow users to adjust parameters such as the loan amount, interest rate, and repayment term to see how these variables affect the monthly payment amount.

By experimenting with different options, students can determine the most suitable loan structure for their individual needs and financial situation.

Interest Rate

The interest rate is the percentage of the loan amount that is charged as interest each year. A higher interest rate will result in a higher monthly payment, as more interest will be charged each month.

Loan Term, Calculate loan payment student

The loan term is the length of time over which the loan is repaid. A longer loan term will result in a lower monthly payment, as the interest is spread out over a longer period of time.

| Loan Amount | Interest Rate | Loan Term | Monthly Payment |

|---|---|---|---|

| $10,000 | 5% | 10 years | $106.46 |

| $20,000 | 5% | 10 years | $212.93 |

| $10,000 | 10% | 10 years | $123.28 |

| $10,000 | 5% | 20 years | $58.33 |

As shown in the table, the monthly payment for a student loan can vary significantly depending on the loan amount, interest rate, and loan term. Borrowers should carefully consider these factors when making decisions about their student loans.

Additional Considerations

Additional Payments and Refinancing

Making additional payments towards your student loans can significantly reduce the overall cost of the loan. Even small additional payments can make a big difference over time. For example, making an extra payment of $50 per month on a $10,000 loan with a 6% interest rate can save you over $1,000 in interest and shorten the loan term by over a year.

Refinancing your student loans can also be a way to reduce the overall cost of your loans. Refinancing involves taking out a new loan with a lower interest rate to pay off your existing loans. This can be a good option if you have good credit and can qualify for a lower interest rate.

However, it’s important to weigh the pros and cons of refinancing carefully before making a decision.

For students seeking to finance their higher education, understanding the potential loan payments is crucial. To assist with this, online tools are available to calculate loan payment student loans accurately. These calculators take into account factors such as the loan amount, interest rate, and repayment period to provide a clear estimate of the monthly payments.

By using these tools, students can make informed decisions about their borrowing options and plan for their financial future.

Loan Forgiveness Programs

There are a number of loan forgiveness programs available that can help you pay off your student loans. These programs are typically offered by the government or by private lenders. To qualify for loan forgiveness, you must meet certain eligibility requirements, such as working in a certain field or serving in the military.

Loan forgiveness programs can be a great way to save money on your student loans. However, it’s important to understand the eligibility requirements and the terms of the program before you apply.

Managing Student Loan Payments

Managing student loan payments is crucial for maintaining financial stability and avoiding default. By budgeting effectively and understanding the options available for handling late or missed payments, borrowers can navigate the repayment process successfully.

Budgeting for Student Loan Payments

To budget for student loan payments, borrowers should first determine their monthly expenses, including essential costs like rent, utilities, and food. Once these expenses are accounted for, they can allocate a specific amount towards their loan payments. It’s recommended to set up automatic payments to ensure timely payments and avoid late fees.

Managing Late or Missed Payments

If borrowers face financial difficulties and are unable to make their loan payments on time, they should contact their loan servicer immediately. Loan servicers can provide options such as payment deferment or forbearance, which temporarily pause or reduce payments. Borrowers may also be eligible for loan consolidation or income-driven repayment plans, which can adjust the loan terms to make payments more manageable.

Wrap-Up: Calculate Loan Payment Student

Remember, managing student loan payments is an ongoing process. By budgeting wisely, exploring additional payment options, and staying informed about loan forgiveness programs, you can optimize your repayment strategy and reduce the overall cost of your student loans. With the right approach, you can successfully navigate the repayment journey and achieve financial freedom.

Questions and Answers

What factors influence the monthly payment of a student loan?

The loan amount, interest rate, and loan term are the primary factors that determine the monthly payment.

How can I reduce the overall cost of my student loans?

Making additional payments or refinancing your loan can help you pay off your debt faster and save money on interest.

What options are available for managing late or missed payments?

Contact your loan servicer immediately to discuss options such as deferment, forbearance, or loan modification.